• How to cluster your customer base to adapt your products/services and (E)–marketing in an optimal way?

• How to construct an optimal asset hedge portfolio to reduce the market- and insurance risk resulting from the liabilities towards the policy holders? (ALM)

• How can ‘big data’ consisting of customer and product data be used to recognize patterns in consumer behavior?

• What is the optimal price formula that a telephone company can use given the data about the call behavior of their customers?

• How to use mathematic algorithms to optimize the profit on air plane tickets?

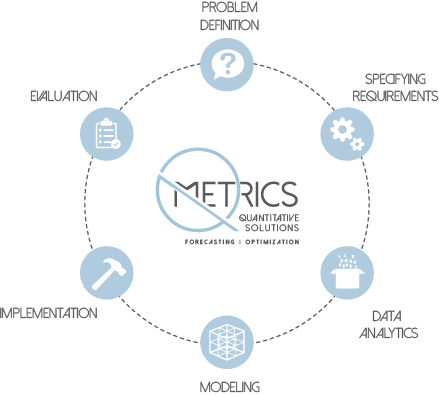

Problem definition

Problem definition Specifying requirements

Specifying requirements Data analytics

Data analytics Modelling

Modelling Implementation

Implementation Evaluation

Evaluation